CIRCLELOOP'S

Recession-proof Index

In September 2022, the Bank of England raised interest rates to 2.25% - its highest level since 2008 - putting Britain’s economy into another recession. No one could have possibly predicted what the last few years had in store or how much businesses would need to adapt in order to survive. It’s impossible to know what's around the corner.

We can’t predict economic downturns, market adjustments or even natural disasters. However, we can prepare for them. Looking to the past can provide some valuable insight that can help you make informed decisions – no matter what the future throws at you.

Startup Survival Guide

Lessons from the Last Recession

For those now experiencing their first recession in business or for those who had plans to launch a new startup in the next 12 months and are worried about what this means, don’t worry - we’ve done the research for you.

Analysing ONS business data from the years following the 2008 recession, we’ve been able to paint a picture of what impact and outcomes can be expected based on previous startup experiences. We’ve identified which industries are the most recession-proof for new business, which regions could see businesses fare the best and how long we can expect to wait to see some recovery of startup success.

We founded Radfield Home Care in early 2008 and grew quickly while the great recession played out. The need for care services grows whether there is recession or not, but it can become easier to recruit staff during a recession. With recruitment being a major limiting factor for many businesses right now, recession may help a little with sourcing labour. We prepared very early for the pandemic and so while many were struggling to find PPE, we were able to keep our staff and clients safe. Early planning for supply chain disruption can really help avoid sticky problems down the line. Recession may bring similar challenges, so early planning for energy and supply chain disruption may be the difference between staying in business and having to call it quits.

Alex Green

Director at Radfield Home Care

Industries

Recession-Proof Industries

01 Health

In the years following the recession, 2009-13, start-ups in the Health industry had the lowest rate of failure after 2 years at an average of 20%, making this industry the most recession-proof for new businesses.

02 Info and Communication

In the years following the recession, 2009-13, start-ups in the Information & Communication industry had the second lowest rate of failure after 2 years at an average of 21%, making this industry one of the most recession-proof for new businesses.

03 Property Industry

It was found to be the least recession-proof in the aftermath of the last recession, with close to a third (32%) of all new businesses failing after 2 years, the highest rate of business failures across all industries from 2009 to 2013. This is closely followed by Business Administration & Support Services (31%) and Finance and Insurance (31%) industries.

regions

Recession-Proof Regions

The least recession-proof regions which saw the highest rates of business failures in 2009 were London (30%), Yorkshire & Humber (28%) and the North East (27%).

01 East & South West

In 2009, over a year after the recession began, start-ups in the East of England & South West saw the joint-lowest rate of business failures of all regions, at 23%.

02 South East

In 2009, over a year after the recession began, start-ups in the South East saw the second lowest rate of business failures of all regions, at 24%.

By 2010 the situation had got worse for some industries which saw further increases to the rate of business failures after 2 years.

Startups in Business Administration & Support Services start up failures increased by 8% to two in every five businesses (40%). Failure of startups in Arts, Entertainment, Recreation & other Services increased by 6% to a third of businesses (33%).

By 2011 recovery is seen across almost all industries with business failure rates significantly increasing.

Startups in Business Administration & Support Services saw a 12% reduction in business failures. Startups in Arts, Entertainment, Recreation & other Services saw a 7% reduction in business failures.

Recovery

Recession Recovery

How the recession affected startups in Business Administration & Support Services and startups in Arts, Entertainment, Recreation & other Services.

Recession-proof

Key Takeaways

- On average, startups founded in the North fare worse as a result of a recession than businesses in the South.

- Startups in Northern Ireland have a higher chance of failure in the immediate aftermath of a recession than those in England, Scotland or Wales.

- It takes around 2 years post-recession for the number of startup failures to decrease across the majority of industries, instead of increasing.

- Property is likely to be the most severely impacted industry, both in terms of initial market shock and slow recovery time.

- The South West and East of England are the most recession-proof regions on average.

- A business launching within the Health industry during a recession has the greatest chance of survival.

Matrix Rankings

The Recession-proof Index

The following table shows the survival rates of startup businesses by industry and UK region, identifying the most recession-proof regions for each industry. This table includes data from 2009 and businesses that survived the last recession with their first two years of launching.

We founded Radfield Home Care in early 2008 and grew quickly while the great recession played out. The need for care services grows whether there is recession or not, but it can become easier to recruit staff during a recession. With recruitment being a major limiting factor for many businesses right now, recession may help a little with sourcing labour. We prepared very early for the pandemic and so while many were struggling to find PPE, we were able to keep our staff and clients safe. Early planning for supply chain disruption can really help avoid sticky problems down the line. Recession may bring similar challenges, so early planning for energy and supply chain disruption may be the difference between staying in business and having to call it quits.

Alex Green

Director at Radfield Home Care

Research approach

Methodology

The data used to create the Chatterbox Matrix was sourced from CircleLoop’s own internal data. Over a period of 6 months in the latter half of 2021, CircleLoop’s customer data was extracted and anonymised. The specific data points sourced were geographical location or town where the business resides, the call count of inbound and outbound calls and the average call duration of inbound and outbound calls.

Call count figures were then divided by total the town population to produce a call volume percentage that represented the share of calls businesses were making in that town. The Chatterbox Score is ranked out of 100, and combines the number of calls per person with the average call duration. The most ‘chatty’ town or city across these two factors is awarded a score of 100, with all other towns and cities being awarded a score relative to the most 'chatty' location.

Are you ready?

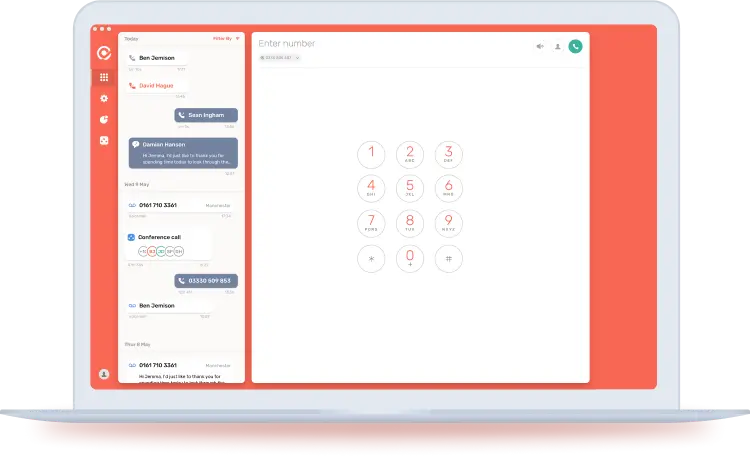

We’re here to help you stay connected

At CircleLoop we’re here to help you stay connected. Our cloud-based phone system offers seamless integrations with a number of other apps and platforms too and provides virtual numbers when you’re looking to call from a particular location while you’re on the go.